ESG vs. CSR vs. sustainability: What’s the difference?

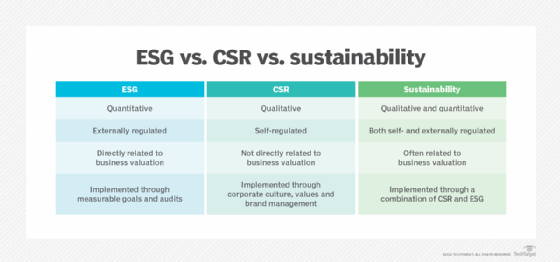

Terms such as environmental, social and governance reporting and corporate social responsibility are being used more to describe how businesses can show their commitment to sustainability.

The two terms have some overlapping meaning and are sometimes used interchangeably. With new tightening expectations and fears surrounding environmental sustainability, businesses should know what these terms mean, how they differ and where they overlap.

Respondents to the World Economic Forum’s “Global Risks Perception Survey” signaled environmental factors as the critical threats to the world. Climate action failure, extreme weather and biodiversity loss were at the top of that list.

According to a 2021 Gartner survey, environmental sustainability is a top business focus for CEOs for the first time in the history of the survey. With fears about the state of the environment growing and the ability to prove ROI for sustainability practices, businesses are under growing pressure to not only behave ethically, but also demonstrate that they are doing so.

For example, in May 2022, the International Sustainability Standards Board outlined a plan for establishing environmental, social and governance (ESG) reporting standards for international investors, which are expected to be complete ESG is a quantifiable assessment of sustainability. ESG strategy focuses on reaching certain performance metrics, setting measurable goals and conducting audits. There are explicit standards surrounding ESG. For example, ratings agencies, like SP, create performance scores using a set of criteria. Investors use these to value businesses and, ultimately, inform their investment choices. Businesses create ESG reports to appeal to investors and other compliance requirements.

ESG encourages businesses to behave ethically. It also helps investors avoid losses when companies behave in a risky manner.

The three main criteria covered ESG deals in defining a company’s financial value and its compliance record. Different investment firms may rate ESG differently based on their own priorities.

What is CSR?

Corporate social responsibility (CSR) is a self-regulating business model that aims to improve society and the environment. It is a looser, general framework for corporate behavior that can vary in terms of its practical implementation. The nature of CSR is qualitative and self-regulating. The ISO 26000 voluntary standard does help companies define social responsibility and provides guidance for achieving it practically.

Good CSR helps companies maintain a positive brand image and boosts stakeholder morale. Companies usually highlight the achievements of their CSR efforts in annual reporting.

Learn why marketing should lead corporate social responsibility efforts to improve a company’s reputation, especially with a Gen Z audience.

In one radical example of CSR, the founder of apparel company Patagonia — Yvon Chouinard — pledged all the company’s future profits to organizations that fight the climate crisis. This was nearly a $3 billion value. Any profit not reinvested in running the business would be distributed to the charity.

Other more run-of-the-mill examples include Starbucks’ commitment to eliminate plastic straws globally — as reported in the “2021 Starbucks Global, Environmental and Social Impact Report” — and The Home Depot’s commitment to improving employee benefits — as reported in its 2021 ESG report.

What is sustainability?

In its broadest definition, sustainability refers to the ability to support and continue a process over time.

Corporate sustainability encompasses the business practices that keep a business alive and perpetuate its success. More specifically, it involves the coordination and management of environmental, social and financial demands to ensure a business is responsible, ethical and continually successful. Sustainability lets businesses meet present needs without compromising the ability of the business to meet its needs in the future.

Corporate sustainability is often broken into three pillars:

- economic, or profits

- social, or people

- environmental, or planet

These three pillars are sometimes referred to as the triple bottom line — a play on the traditional concept of the bottom line. The bottom line in business refers to immediate profit being the number one priority.

The term sustainability is often used in other, nonbusiness contexts to refer to environmental, social, policy or economic sustainability.

Where do ESG, CSR and sustainability overlap?

Sustainability is the umbrella that both terms fall under and contribute to. ESG and CSR are both ways that businesses can demonstrate their commitment to sustainable business practices. CSR can be seen as the idealistic, big-picture perspective on sustainability, and ESG is the practical, detail-oriented perspective on sustainability.

CSR can be seen as the precursor to ESG. Companies self-regulate and commit to sustainable practices with the aim of making a positive impact on society. Then, the efforts undertaken in a CSR strategy can be refined and fit into ESG metrics and reporting. ESG data can then later be reported and shared via ESG reports. ESG puts a quantifiable stamp of credibility on the broad management philosophy of CSR. A business needs both practices to be sustainable.

How to implement each

ESG starts with CSR. For guidance on CSR, companies can consult voluntary standards, such as ISO 26000. When developing a CSR program, companies should consider the following:

- The company’s core competencies. A core competency is something the company is uniquely good at. It could be buying power, product quality or innovation capabilities. For example, a company that excels at minimizing costs can direct money toward an environmental activism organization. Companies should strive to embed sustainability into existing processes.

- The issues that customers care about. These could be environmental or social issues taken in a survey or the aspects of the company or brand that resonate with customers. A company could survey customers about issues they most care about and align that with a product they respond positively to.

- The issues that employees care about. Companies can survey employees about what means a lot to them and provide volunteering opportunities.

- Quantifying the results of efforts that are tied to the bottom line. A company that sets the goal of reducing waste might want to measure its progress to later report to its audience and investors in an ESG report.

- Current societal, industry and environmental trends. If a climate report has just been released, a company might align its goals with the data contained in the report. If a natural disaster has taken place, a company might align its CSR strategy with the discourse surrounding the disaster When constructing an ESG strategy, companies should also consider the above factors. ESG strategies must also consider reporting laws and requirements, as well as investor interests, because ESG is more closely tied to compliance and seeking funding. There are many frameworks companies can consult when developing an ESG strategy, including the following:

- United Nations (U.N.) Sustainable Development Goals;

- Sustainability Accounting Standards Board’s Materiality Map;

- U.N. Guiding Principles on Business and Human Rights;

- Carbon Disclosure Project;

- Dow Jones Sustainability Indices;

- Global Reporting Initiative; and

- Task Force on Climate-Related Financial Disclosures.

Below are some general steps to begin formulating an ESG strategy:

- Assemble a qualified, cross-functional team of stakeholders.

- Perform a business impact analysis.

- Perform a materiality assessment to determine what is important to the company.

- Define measurable goals.

- Develop a roadmap to meet goals.

- Implement action plans, and report progress along the way.

Which approach is better?

ESG provides a clearer material path to business sustainability. However, a philosophy of CSR is necessary to put an ESG plan into practice. ESG might also be considered better because it involves a more comprehensively designed plan that is regulated Early in 2022, the United States Securities and Exchange Commission proposed ESG reporting guidelines, so a more specific, measurable ESG plan might be preferable to a loosely defined CSR approach. Businesses will likely need the quantitative element of ESG to comply with these regulations, should they be enacted.

One place where CSR may have the advantage over ESG is in promoting elements of a corporation’s sustainability goals to internal employees and boosting morale among staff and customers. CSR is better for developing a company culture that empowers employees.